Net-Zero Roadmap for Vietnam’s Steel Industry

Global Efficiency Intelligence: Ali Hasanbeigi, Cecilia Springer, Cassandra Savel, Truong Quang Truong

ASEAN Centre for Energy: Dan Resky Valeriz, Zulfikar Yurnaidi, Vu Trong Duc Anh

Vietnam has committed to achieving net-zero greenhouse gas (GHG) emissions by 2050. As the country advances toward its climate targets, emissions from the steel sector will need to peak and decline. Steel production in Vietnam is highly carbon-intensive due to the large share of primary blast furnace-basic oxygen furnace (BF-BOF) steelmaking. With continued investment in new BF-BOF capacity, Vietnam will face challenges in decarbonization of the steel sector. This report provides an overview of steel production, energy use, and emissions trends in Vietnam and presents a data-driven roadmap for deep decarbonization through to 2060. It evaluates multiple technology and policy pathways through scenario analysis and outlines key milestones for 2030, 2040, 2050, and 2060. The report concludes with actionable policy recommendations for Vietnam’s government, steel producers, consumers, and other relevant stakeholders.

While Vietnam produces a smaller share of the world’s steel than some major producers, it is one of the fastest-growing steel-producing countries in Southeast Asia. In 2023, Vietnam produced approximately 19 million tons (Mt) of crude steel and was the 12th largest steel-producing country. The steel production is expected to grow to up to 55 Mt per year in 2060. The steel industry is an important pillar of Vietnam’s economic development, underpinning the country’s rapid infrastructure expansion, supporting key manufacturing sectors such as construction and shipbuilding, and contributing to export revenues and industrial employment.

The Net-Zero Roadmap for Vietnam’s Steel Industry (‘Roadmap’) describes the current status of Vietnam’s steel industry and outlines four future industry development scenarios: Business-as-Usual (BAU), Moderate, Advanced, and Net-Zero, looking at the impacts of these scenarios through to 2060. Although Vietnam’s net zero commitment is for 2050, the relatively young fleet of BF-BOF plants in Vietnam will make this challenging, and hence our study timeline goes through 2060.

The analysis applies five core decarbonization pillars:

1) material efficiency and demand management

2) energy efficiency and electrification of heating

3) fuel switching and cleaner electricity

4) transitioning to low-carbon iron and steelmaking technologies, and

5) carbon capture, utilization, and storage (CCUS).

We estimated the total final energy use and CO2 emissions of the steel industry in Vietnam through 2060 under four scenarios: Business-as-Usual (BAU), Moderate, Advanced, and Net-Zero, with the scenarios varying in their degree of adoption of technologies under each decarbonization pillar. Figure 1 shows the projected emissions trajectory for Vietnam’s steel industry under each scenario. In the BAU scenario, emissions from the steel industry are projected to grow through 2060, driven by significant growth in crude steel production with only moderate levels of energy efficiency improvement and shifting to low-carbon technologies. The Net Zero scenario has the greatest reduction in emissions for Vietnam’s steel industry, based on slower growth in crude steel production resulting from material efficiency and steel demand management in the economy, aggressive energy efficiency measures, the highest adoption of transformative low-carbon iron and steelmaking technologies like scrap-EAF, natural gas-based direct reduced iron (NG-DRI) or green hydrogen-based DRI (H2-DRI), and more CCUS. Under the Net Zero scenario, the total CO2 emissions of Vietnam’s steel industry would be lower by 89% relative to 2023 emissions, and by 95% relative to the BAU scenario’s emissions in 2060.

Figure 1: Total annual CO2 emissions in the steel industry in Vietnam under four decarbonization scenarios, 2023-2060 (Source: this study)

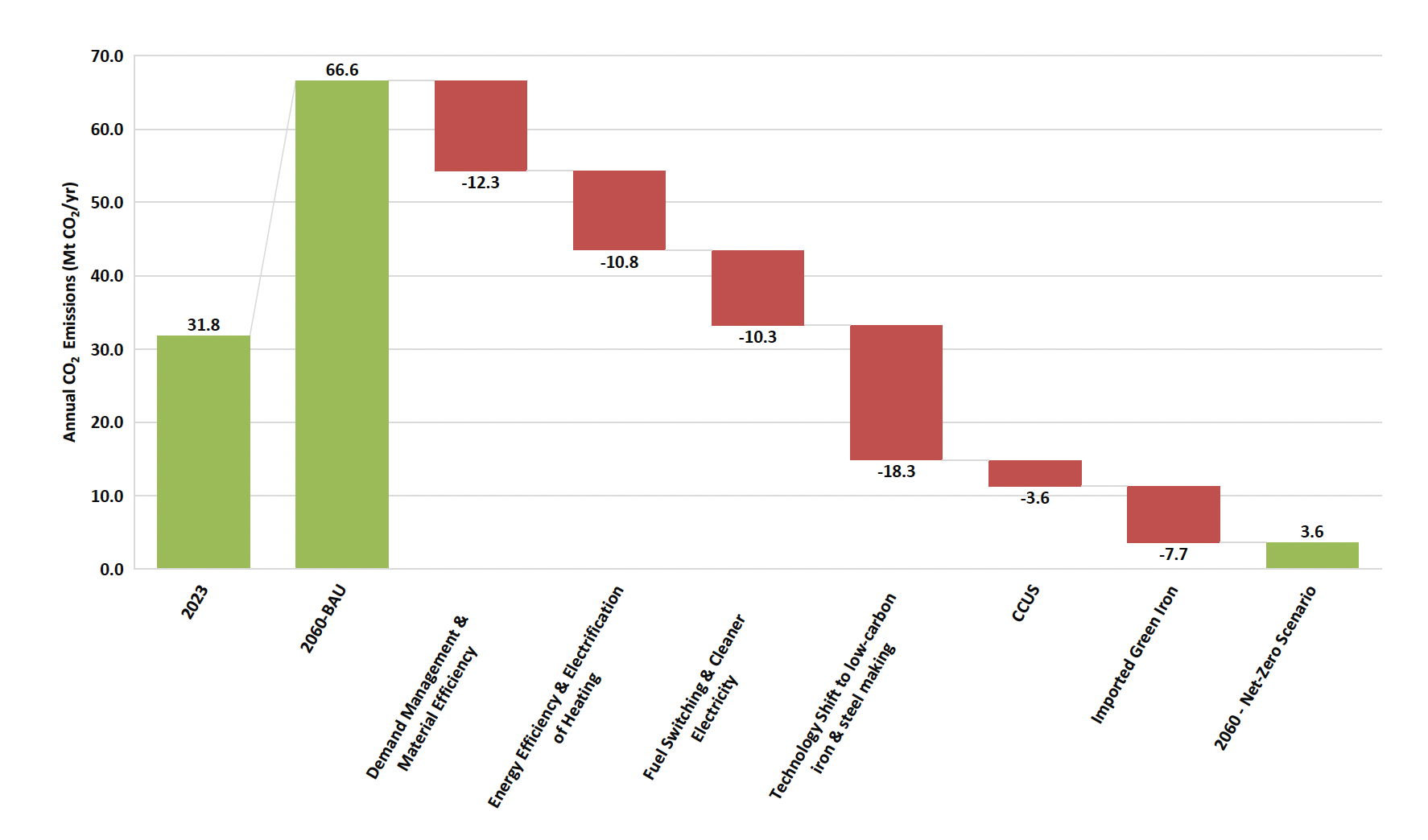

The Roadmap shows how much each decarbonization pillar contributes to total decarbonization. Figure 2 below breaks down the emissions reduction contribution of each pillar for the Net Zero scenario in 2060 relative to the BAU scenario’s emissions in 2060. The technology shift to low-carbon iron and steelmaking pillar is projected to have the greatest amount of emissions reduction potential, and it combines multiple lower-carbon steelmaking technologies like scrap-based EAF, NG-DRI-EAF, and green H2-DRI-EAF, and electrolysis of iron ore. Material efficiency and demand management has the second-largest emissions reduction potential. The energy efficiency and electrification of heating, and fuel switching and cleaner electricity contribute roughly the same amount to emissions reductions. Our analysis shows that the impact of CCUS will be lower than other decarbonization pillars. We have also assumed a small amount of green iron produced by green H2-DRI is imported (10% in of total steelmaking in 2050 and 15% in 2060 under the Net Zero scenario) and then used in EAFs in Vietnam to produce steel. Figure 2 below shows the contribution of this imported green iron in decarbonization of steel production in Vietnam.

Figure 2. Impact of each decarbonization pillar on CO2 emissions of Vietnam’s steel industry, Net Zero scenario relative to BAU (Source: this study)

The Roadmap also shows the contribution of each pillar over time in terms of bringing the BAU scenario’s emissions down to Net Zero levels (Figure 3). The area of the graph that shows each pillar in different colors shows the cumulative contribution of each decarbonization pillar to the total decarbonization of the steel industry in Vietnam from 2023 to 2060. While material efficiency/demand management, energy efficiency/electrification of heating, and fuel switching/cleaner electricity play a large role between the base year and 2030, from 2030 onwards, the technology shift to low-carbon iron and steelmaking pillar plays the largest role. CCUS and imported green iron are also expected to play a small role, with adoption starting in 2030s.

Figure 3. Impact of decarbonization pillars on CO2 emissions of Vietnam’s steel industry to bring BAU emissions down to the Net Zero scenario’s level (Source: this study)

The Roadmap also evaluates the economic feasibility of three lower-carbon steel production routes, scrap-EAF, green H₂-DRI-EAF, and NG-DRI-EAF steelmaking, relative to BF-BOF. Our analysis shows that scrap-based EAF steelmaking in Vietnam has similar costs as BF-BOF at current scrap prices, and could be competitive if scrap prices remain stable or decline. The cost structure for EAF is heavily dominated by scrap costs (around 75%), highlighting the importance of stable and reliable scrap supply to sustain competitiveness.

Green H₂-DRI-EAF offers up to 97% CO₂ emissions reductions compared with the BF-BOF pathway. We project that green H₂-DRI-EAF will be more expensive than BF-BOF even at a hydrogen price of $1/kg under current input material costs, especially coal and coke prices. This is primarily because of the lower price for both coking coal and thermal coal and especially a substantial drop in price in the past two years making BF-BOF production more cost-competitive. However, the green steel premium is expected to narrow as hydrogen costs fall due to technological improvements and stronger policy support (Figure 4). Our analysis finds that while Vietnam currently faces a higher green steel premium per ton of steel due to the early stage of its hydrogen infrastructure development, the green steel premium per unit of the final product remains relatively small: around $285 per passenger car and $790 per residential building unit (50 m2), indicating that green steel adoption would have minimal impact on end-user affordability. Moreover, the introduction of carbon pricing and ongoing declines in hydrogen production will make green H₂-DRI-EAF increasingly competitive.

Figure 4. Levelized Cost of Steel ($/t crude steel) with varied levelized costs of green H2 at different carbon prices in Vietnam (Source: this study)

Notes: Assumed 5% steel scrap is assumed to be used in both BF-BOF and DRI routes. For this analysis, it is assumed that carbon pricing will be applied in the form of credits or allowances for green H2-DRI-EAF plants. Eligible plants would receive carbon credits based on the reduction of their carbon intensity relative to the benchmark set by BF-BOF operations, which can then be traded on the carbon market.

This Roadmap shows that achieving Net Zero emissions for Vietnam’s iron and steel sector will require unprecedented uptake of low-carbon technologies. The roadmap lays out an action plan for Vietnam’s government, steel companies, steel consumers, and other stakeholders to enable this transition.

Summary of recommendations

Enhancing Material Efficiency and Demand Management:

In the near term (2025–2030), the Government of Vietnam should focus on issuing national guidelines to optimize steel use in construction, embedding material efficiency criteria into public procurement processes to reward reduced steel consumption, and launching large-scale awareness campaigns to spread efficient design practices among architects, engineers, and developers. Vietnamese steel producers should carry out detailed assessments of their production lines to identify sources of material waste and improve yields, accelerate the production of high-strength, lightweight steel grades to cut steel use in end applications, and set internal targets for material efficiency to ensure these practices are institutionalized throughout their operations.

For the medium term (2030–2040), the Government of Vietnam should introduce mandatory material intensity reduction targets for key steel-consuming sectors such as construction and automotive, update infrastructure design standards to require efficient use of steel in public projects, and promote industrial symbiosis programs to increase scrap reuse across sectors. Steelmakers should deploy advanced digital tools for real-time yield monitoring to continually reduce scrap and offcuts, and participate in cross-sector networks to exchange scrap and by-products, maximizing resource efficiency and cutting the demand for primary steel.

Enhancing Energy Efficiency and Electrification of Heating:

In the near term, the government should require steel plants to conduct comprehensive energy audits to set efficiency baselines, expand support for waste heat recovery installations to reuse heat from steel processes, and develop guidelines for electrifying low- and medium-temperature heating systems. Steel producers should prioritize quick-win improvements like sealing furnace leaks, enhancing combustion control systems, investing in waste heat recovery, and replacing outdated burners with modern, efficient ones to cut energy consumption and emissions.

By the medium term, steel producers should implement real-time energy monitoring systems in large facilities to ensure continuous efficiency improvements. Companies should electrify rolling mills and finishing lines with clean electricity sources, integrate AI-powered energy management systems to dynamically optimize furnace operations, and shift high-impact processes like ladle preheating to electric heating, further reducing dependence on fossil fuels.

Enhancing Fuel Switching and Cleaner Electricity:

In the near term, policies must guarantee that the steel sector’s renewable electricity needs are considered in Vietnam’s power sector expansion plans. The government should establish a clear legal framework for corporate renewable PPAs and simplify processes for businesses to procure renewable electricity. Steel companies should carry out detailed feasibility studies on switching from coal to cleaner fuels like natural gas as a transitional step, sign long-term renewable PPAs to secure clean power, and retrofit existing combustion systems to prepare for future fuel transitions.

For the medium term, Vietnam should require major industrial consumers, including steel plants, to progressively increase the share of renewables in their electricity consumption. Reforms to industrial electricity tariffs should encourage steelmakers to shift loads to off-peak times when renewable power is more abundant, and the national grid should be modernized and expanded to ensure steel producers can access low-carbon electricity. Establishing a national task force on industrial fuel switching and investing in on-site hydrogen storage and distribution infrastructure will be key, alongside steelmakers committing to science-based emission targets that include concrete timelines for switching to cleaner energy.

Transitioning to Low-Carbon Iron and Steelmaking Technologies:

In the near term, the government should restrict new blast furnace approvals and redirect incentives toward electric arc furnace (EAF) and direct reduced iron (DRI) technologies, strengthen scrap collection networks and enforce quality standards for scrap used in EAFs, and offer financial incentives for upgrading existing facilities or building new EAF and DRI plants. Additionally, Vietnam should plan the development of green hydrogen production hubs near major steel regions, publish national guidelines for hydrogen-ready DRI plants, and launch pilot programs to demonstrate low-carbon steelmaking technologies like hydrogen-based DRI.

For the medium term, Vietnam should set a clear schedule for phasing out high-emission blast furnace-basic oxygen furnace (BF-BOF) lines beyond specified CO₂ benchmarks, support pilot-scale hydrogen DRI plants, facilitate green iron imports as part of a diversified low-carbon supply strategy, and integrate renewable electricity directly into EAF operations by upgrading power infrastructure and reforming electricity markets. Creating certification systems for green steel products and carbon credits will also be essential to incentivize low-carbon production and ensure competitiveness in future markets.

Adopting Carbon Capture, Utilization, and Storage (CCUS):

In the near term, the government should release a comprehensive CCUS roadmap highlighting steel-sector priorities, create clear legal and regulatory frameworks for CO₂ capture, ownership, liability, and storage permitting, and conduct geological studies to identify and evaluate potential storage sites. Providing funding for early pilot CCUS projects at steel plants and encouraging companies to conduct feasibility studies for implementing capture systems will help build local expertise and reduce technology risk. Steelmakers should collaborate with technology providers to tailor solutions for their specific processes.

In the medium term, the focus should shift to building shared CO₂ transport and storage infrastructure to lower costs and enable smaller steelmakers to access CCUS solutions. The government should create incentives for industries to use captured CO₂ in commercial applications like construction materials or fuels, while pursuing international cooperation with experienced countries to gain technical knowledge and secure concessional financing. Steel companies should progress from pilots to full-scale CCUS installations, partner with other industries on shared infrastructure, and pilot innovative uses of captured CO₂ to create valuable products.

Recommendations for Steel Buyers:

In the near term, government procurement processes should mandate the inclusion of Environmental Product Declarations (EPDs) or verified carbon footprints in tenders to favor low-carbon steel suppliers. Large private sector buyers, including developers and manufacturers, should adopt green procurement standards that reward suppliers providing verified low-emission products. Key steel consumers should issue forward-looking commitments to purchase green steel, sending clear demand signals that will encourage steelmakers to invest in cleaner technologies.

In the medium term, Vietnam should expand green public procurement to all major infrastructure projects to create stable demand for low-carbon steel. Procurement guidelines should include incentives for suppliers who exceed sustainability standards, while industry groups and NGOs can coordinate buyer alliances to combine demand and accelerate investments in clean steel. Promoting indirect demand signals, such as including green steel requirements in building codes or investor reporting frameworks, will help mainstream low-carbon steel and drive the market towards more sustainable production.

Figure 5. Examples of recommendations for decarbonizing the steel industry in Vietnam

To read the full report and see complete results and analysis of this new study, download the full report from the link above.

Interested in data and decarbonization studies on the global steel industry? Check out our list of steel industry publications on this page.

Don't forget to follow us on LinkedIn and X to get the latest about our new blog posts, projects, and publications.