Industrial Electrification with Heat Pumps in California, Colorado, and Washington

The U.S. industrial sector is a major contributor to economic growth and productivity, but also accounts for 38% of total U.S. CO₂ emissions, with process heating responsible for more than half of industrial energy-related emissions. Approximately 90% of manufacturing process heat in the U.S. is currently generated from fossil fuel combustion, primarily natural gas. Industrial heat pumps present a promising alternative, capable of meeting heating demands up to 170°C with commercially available technology. In fact, low- and medium-temperature processes represent two-thirds of U.S. industrial heat demand, representing a significant opportunity for electrification.

Industrial heat pumps can reduce energy consumption, lower emissions, potentially lower energy costs, and shift industrial energy use toward clean electricity sources. States such as California, Colorado, and Washington are leaders in renewable energy deployment, and these states offer a strategic opportunity to leverage industrial electrification as a tool to enhance energy efficiency, meet climate goals, and improve industrial competitiveness. However, despite the benefits of electrified industrial heating, technological, market, and policy barriers have slowed large-scale adoption. This report aims to address these challenges by analyzing the potential for steam-generating heat pumps to replace fossil fuel-fired steam boilers in California, Colorado, and Washington.

The industrial sectors in California, Colorado, and Washington differ significantly in scale, energy consumption, and key industries. California is the third-largest industrial energy consumer in the U.S., using between 834 and 1241 PJ of energy annually, with 79-87% from fuel sources. The chemicals and petrochemicals sector dominates, consuming over 430 PJ per year, followed by food and beverages, metals, nonmetallic minerals, and paper production. Colorado’s industrial sector is smaller, consuming around 200 PJ annually, with 71-81% from fuel-based sources. Its largest energy users are chemicals, food and beverage processing, and metals. Washington’s industrial sector uses nearly 300 PJ annually, but with a higher share of electricity use due to its abundant hydroelectric power (55-72% of energy use from fuel sources). The paper and printing industry is a major energy consumer, along with chemicals and wood products.

This study evaluates the potential for industrial electrification through steam-generating heat pumps (up to 170°C) in the food and beverage industry and the paper industry in California, Colorado, and Washington by assessing energy demand, CO₂ emissions, electricity load impacts, and costs for a typical facility in each studied sector and at the state level. The analysis compares conventional steam boilers and industrial heat pumps for 2030, 2040, and 2050, using projections for grid emissions factors, energy prices, and carbon pricing. The study considers two electricity supply scenarios: a Grid only scenario and a Grid Plus RE Procurement scenario, where facilities procure increasing shares of renewable electricity. Cost analysis includes fuel, electricity, and carbon costs (California and Washington currently have emissions trading systems, and we assumed Colorado would adopt some form of carbon pricing over the timeline of this study).

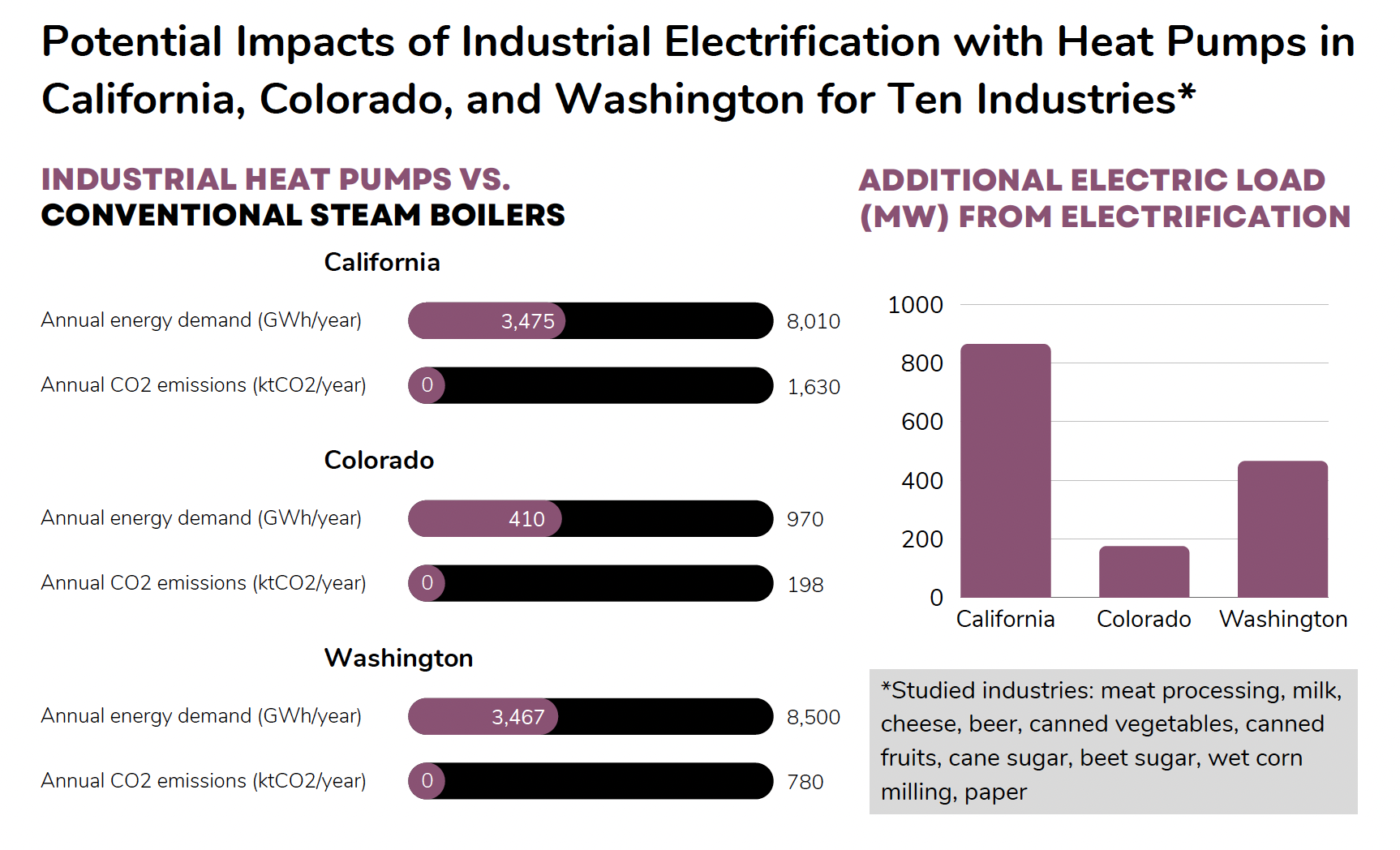

We find that heat pumps can significantly reduce energy demand for steam production in all studied industrial subsectors and states. Heat pumps can also reduce CO2 emissions across all industries and states by 2030, driven by increased efficiency and decarbonizing electricity supply. Washington has the largest energy savings potential of the states studied, at over 5,000 GWh per year, due to being a major manufacturer of primary paper, for which electrification with heat pumps can significantly reduce energy use for drying. California had the largest emissions reduction potential, with the potential to mitigate 3,475 kt CO2 per year from heat pump adoption due to its large food and beverage sectors and its relatively decarbonized grid. Colorado’s energy savings potential and emissions reduction potential are smaller, at 560 GWh/year and 200 kt CO2 per year, respectively. Although electrification reduces overall energy use for steam production, it necessarily increases electrical load. Figure 1 shows the state-level results for the study and the magnitude of electrical load increase from electrification with heat pumps across all sectors studied.

Figure 1: Summary of study results in heat pump impacts on energy use, emissions, and electrical load in California, Colorado, and Washington in 2050

Energy costs for heat pumps are expected to be lower than for conventional boilers in 2030 in Washington for all sectors (except paper) under either electricity supply scenario, and in all sectors in Colorado except beer under the Grid scenario. However, in California, energy costs in 2030 from heat pumps are expected to be higher due to California’s high electricity prices. Over time, integration of lower-cost renewable energy is expected to bring heat pump energy costs below those of conventional boilers in California. Washington has the most favorable “spark gap ratio”, or electricity-to-fuel price ratio, for electrification, with low industrial electricity prices and middling natural gas prices. California has the highest spark gap ratio, making electrification challenging in the near term without greater availability of lower-cost RE procurement for facilities or increased carbon pricing.

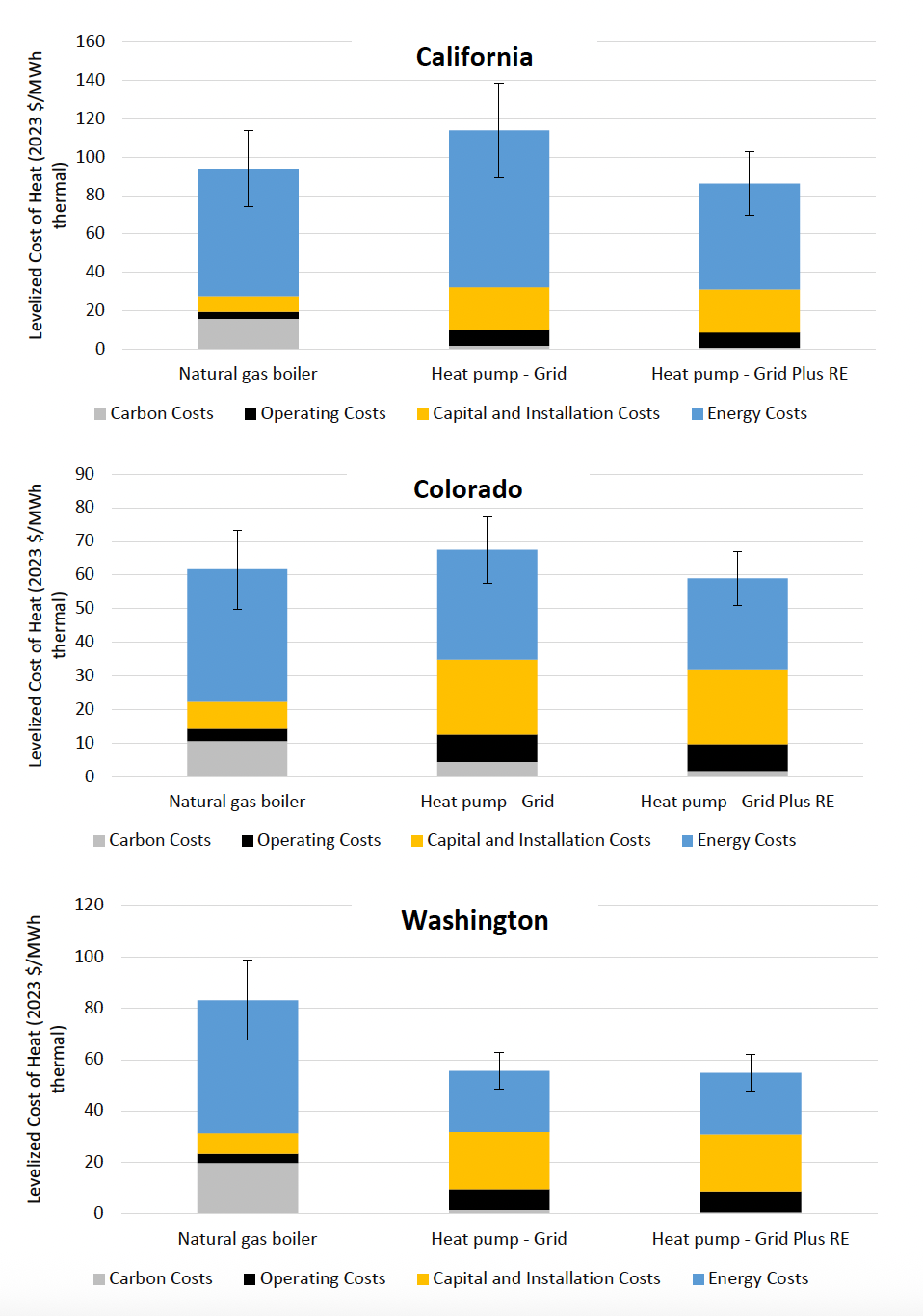

Looking at energy costs over the lifetime of heat pump and boiler technologies, and also incorporating carbon costs, operating costs, and capital and installation costs, we calculated the Levelized Cost of Heating (LCOH) for steam production at a typical industrial facility in each state for natural gas boilers and heat pumps. We found that in California and Colorado, despite the significant capital and installation costs for heat pumps, they could have a slightly lower LCOH than natural gas boilers under the Grid Plus RE scenario with greater integration of low-cost renewable electricity. In Washington, heat pumps have a lower LCOH across scenarios, driven by favorable electricity prices in the state.

Figure 2: Levelized cost of heat (LCOH) for industrial steam production in the three states

Note: The error bars represent an energy price sensitivity of +/- 30%

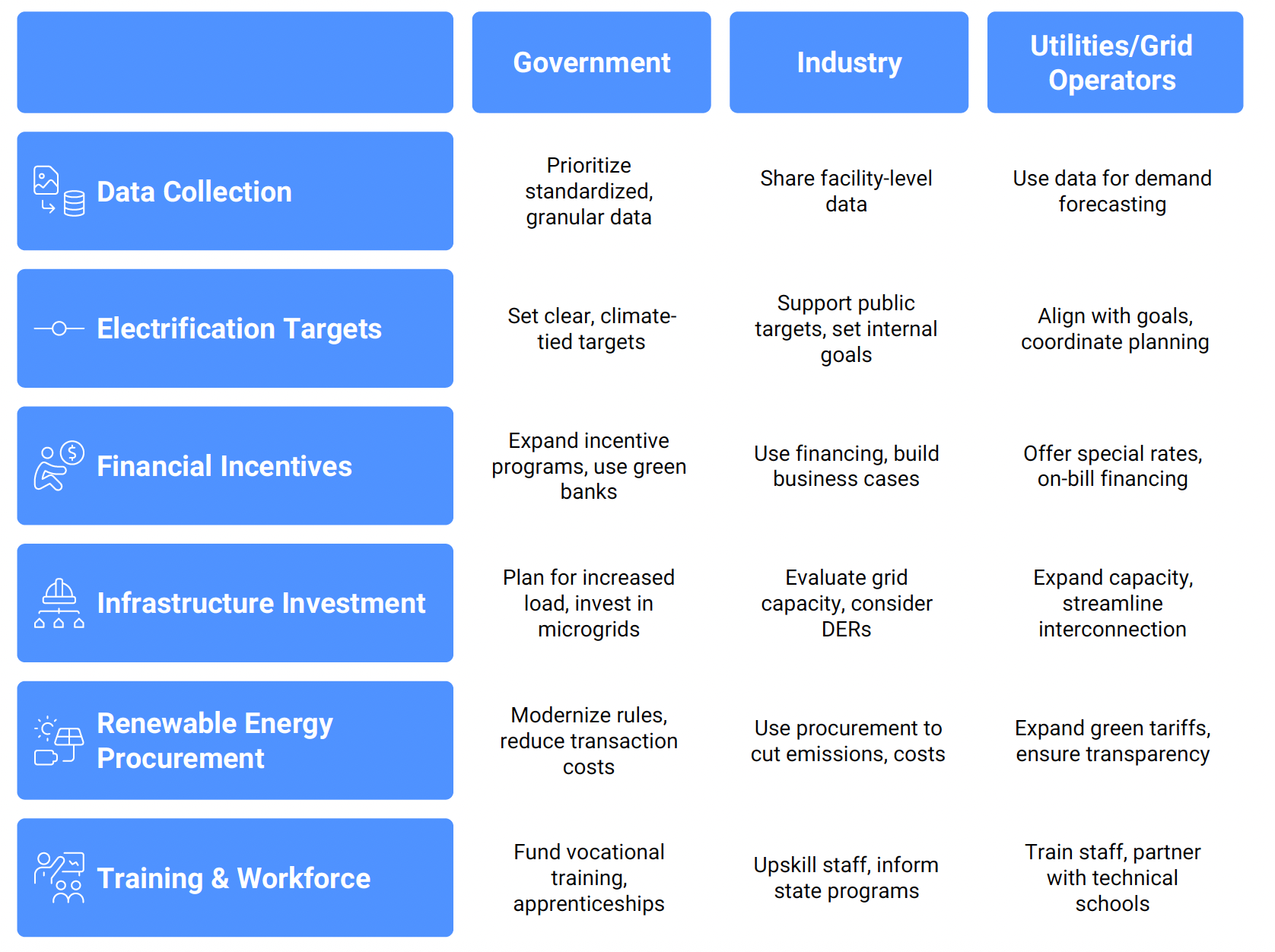

To accelerate industrial electrification with heat pumps in California, Colorado, and Washington, we put forth recommendations for government, industry, and utility stakeholders in several key areas. First, state agencies should make efforts to collect granular data on industrial heating needs and electrification potential, enabling more targeted policy design and investment planning. States should also set clear electrification targets aligned with their clean energy goals—such as SB 100 in California, HB 19-1261 in Colorado, and CETA in Washington—and ensure that utilities incorporate these targets into grid planning and demand-side programs.

To overcome cost barriers, governments should expand financial incentives for electric process heat technologies, including targeted grants and green financing programs, while utilities should offer supportive rate designs, green tariffs, and on-bill financing.

Public and private sector collaboration on blended finance and risk mitigation will be key to scaling investment. Grid infrastructure must also be modernized to support rising industrial electricity demand, with proactive planning for interconnection and distributed energy integration. At the same time, streamlining corporate renewable energy procurement through improved PPA approval processes and utility green tariff expansion will help industries access affordable, zero-carbon electricity. Finally, state workforce agencies, utilities, and manufacturers must invest in training programs to ensure a skilled workforce capable of implementing and maintaining industrial electrification technologies.

Figure 3: Summary of policy recommendations to support industrial heat pump adoption in the three studied states

Download the full report for detailed results on energy saving, CO2 emissions, and costs for 10 industry sub-sectors in each state from the link above.

Stay up to date with our work on electrifying the industrial sector through the Industrial Electrification Center.

Don't forget to follow us on LinkedIn and X to get the latest about our new blog posts, projects, and publications.