U.S. Border Carbon Adjustment for Steel and Aluminum

Author: Ali Hasanbeigi, PhD

The industry sector accounts for over one-third of global anthropogenic greenhouse gas (GHG) emissions. The steel and aluminum industry combined account for around 13% (steel, 11%, and aluminum, 2%) of global CO2 emissions. The emissions from these heavy industries must be reduced sharply for the world to reach the target of the Paris Climate Agreement: to limit global warming to “well below” 2 ℃.

Approximately 24% of the total steel and 33% of the total unwrought aluminum and aluminum alloys produced globally is traded across borders. The U.S. imported around 25 million tonnes (Mt) of steel products, and 4.8 Mt of crude and semimanufactures aluminum from other countries, which accounts for a large share of steel and aluminum consumed in the U.S. Since carbon intensity of steel and aluminum production vary substantially between countries, the heterogeneous climate policies across countries risk intensifying carbon leakage as production continues to shift to countries with lower climate ambition or lesser-regulated countries.

The U.S. steel and aluminum industries have a substantial carbon advantage over many countries it is importing steel and aluminum. On average (including both primary and secondary processes), they emit lower CO2 emissions to produce a tonne of steel and aluminum compared to many other countries. This carbon advantage should be leveraged to reward domestic cleaner steel and aluminum production and encourage the decarbonization of these two industries in other countries. Around 100% of steel and 66% of aluminum imported to the U.S. is from countries that have higher average CO2 emissions intensity per tonne of steel and aluminum than that of the U.S. A carbon fee and border adjustment would unlock a competitive advantage for the U.S. steel and aluminum industry. Border Carbon Adjustment (BCA) is a policy tool for preventing carbon leakage as some countries, such as the U.S., are taking serious actions to tackle the climate crisis and achieve Paris Agreement’s target.

This study analyzes the production and trade of steel and aluminum in the U.S. and the carbon competitiveness of the U.S. steel and aluminum industry. We developed three different scenarios to assess the impact of a potential U.S. BCA on GHG emissions and revenue of the steel and aluminum industry in the U.S. up to 2030. The three scenarios are (See Section 5.1 for a more detailed explanation):

• Scenario 1: Average CO2 intensity of steel/aluminum in each country is used (Has domestic CO2 price)

• Scenario 2: Average CO2 intensity of steel/aluminum used for developed countries and economy-wide intensity for developing countries (Has domestic CO2 price)

• Scenario 3: Country-specific primary and secondary steel/aluminum CO2 intensity are considered separately (Has domestic CO2 price)

In these scenarios, the carbon levy on imports is applied to the difference between the CO2 intensity of U.S. steel and aluminum production and the CO2 intensity in countries the U.S. is importing steel and aluminum. These scenarios also include a carbon levy for domestic steel and aluminum producers in the U.S. whose CO2 intensity is above the U.S. industry baseline.

We conducted this scenario analysis using three different carbon price levels (low, medium, and high). We then discuss policy design considerations for a BCA policy based on international practices and discuss the trade implications of a BCA policy.

Figure ES1 shows the total annual revenue of BCA for steel, aluminum, and steel contained in passenger cars. This includes import revenue plus net domestic revenue after the export rebate. The total annual revenue of BCA ranges from $578 million to $2,047 million for steel, $206 million to $1,084 million for aluminum, and $39 million to $280 million for steel contained in passenger cars in 2024. These annual revenues will substantially increase in 2030 as the price of carbon increases.

Figure ES1. Total annual revenue of BCA for steel, aluminum, and steel contained in passenger cars (import revenue plus net domestic revenue after export rebate) under MED carbon price (Million $/year)

Scenario 1: Average CO2 intensity of steel/aluminum in each country is used (Has domestic CO2 price)

Scenario 2: Average CO2 intensity of steel/aluminum used for developed countries and economy-wide intensity for developing countries (Has domestic CO2 price)

Scenario 3: Country-specific primary and secondary steel/aluminum CO2 intensity are considered separately (Has domestic CO2 price)

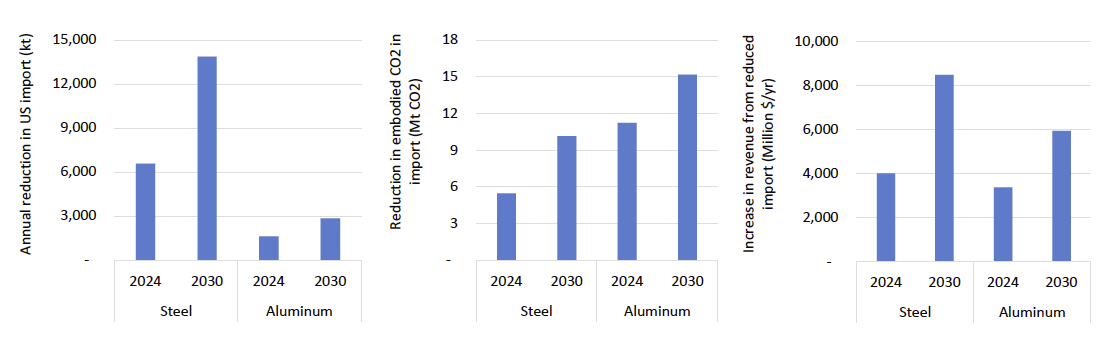

The reduction in imported steel as a result of U.S. BCA for steel under MED carbon price in Scenario 1 is equal to 26% in 2024 and 55% in 2030 of total imported steel in the U.S. (Figure ES2). This translates into a reduction in embodied carbon in imported steel equal to 15% in 2024 and 27% in 2030 of total embodied CO2 in imported steel in the U.S. (Figure ES2). This is because the weighted average CO2 intensity of steel production in the U.S. (primary and secondary) is substantially lower than that in most other countries from which it is importing steel. The increase in annual revenue of U.S. steel companies as a result of reduced U.S. imports is around $4,000 million in 2024 and $8,500 million in 2030. The results for the U.S. BCA for aluminum are also presented in Figure ES2.

Figure ES2. Reduction in annual imports and their associated CO2 and Increase in annual revenue of U.S. steel/aluminum companies as a result of U.S. BCA under MED carbon price in Scenario 1

The import carbon fee for steel contained per passenger car ($/car) is minimal compared with an average price of a passenger car in the U.S., and therefore it is highly unlikely that such a carbon fee will result in a reduction in cars imported to the U.S.

The increase in the U.S. steel and aluminum industry’s annual revenue resulting from the reduced steel and aluminum import caused by U.S. BCA will be distributed across all regions in the U.S. For the steel industry, the steel plants in the Southern and Great Lakes region will benefit the most.

Our analysis shows that even if only 75% of the total revenue from a U.S. BCA for steel, aluminum, and steel contained in passenger cars is spent domestically (with the remaining 25% spent internationally to help decarbonize the industry sector in developing countries as proposed by Clean Competition Act by Senator Sheldon Whitehouse), it still will put substantially more money back into the U.S. industry than the carbon levy domestic producers will have to pay.

There are different policy design considerations when planning for a BCA policy. Some of the key policy components are identifying objectives, determining targets, establishing tax base and enforcement mechanisms, and measuring the impact on trade, carbon, and policy.

The Border Carbon Adjustment policy has serious implications for trade relationships/ agreements involving both developing and developed countries. Its impact is associated with bilateral, multilateral, and WTO trade agreements. Introducing a BCA might change trade patterns in favor of countries with carbon-efficient production. However, if the carbon export rebate and import tax are equal to the domestic carbon tax in the BCA program, then the BCA is theoretically trade-neutral; thus, it does not encourage or discourage trade. Nonetheless, there is concern that implementing the BCA policy could lead to retaliatory tariffs or trade wars. To be successful, a BCA must be accompanied by multilateral and bilateral cooperation initiatives regarding climate mitigation and carbon emissions reduction. An example of this is the U.S.- EU Carbon-Based Sectoral Arrangement on Steel and Aluminum Trade.

To read the full report and see complete results and analysis of this new study, Download the full report from the link above.

Don't forget to Follow us on LinkedIn, Facebook, and Twitter to get the latest about our new blog posts, projects, and publications.